Posts Tagged ‘college’

Obama to bypass Congress again – new student loan rules

In 2010, Congress pass and President Obama signed the Health Care and Education Reconciliation Act. Along with cutting off the private student loan market by removing subsidies, making loans pretty much the exclusive realm of the federal government, the legislation capped the repayments of new loans to 10 percent of the persons discretionary income. The previous cap…

Read MoreBrown University To Cover Student Sex Change Operations

What can I add to this? It appears that the Fluke controversy has extrapolated to sheer insanity. Tuition subsidized insanity. “The Brown Student Health Insurance Plan will cover 14 different sexual reassignment surgery procedures for students starting August, reports the Brown Daily Herald student newspaper.” reports the College Fix. “For female-to-male surgeries, the new coverage…

Read MoreMore government intrusion

This time it is the Department of Education that would seem to be overstepping its bounds. Thanks to their vigilence, we will today learn the identities of the most expensive colleges and universities in the United States, based upon data that the colleges and universities are required to file with the federal government. This information,…

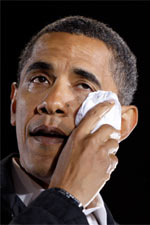

Read More“My son’s losing hope” Obama: But we passed health care and took over student loan industry

Broken record indeed. The only answer President Obama has in response to questions like the one asked yesterday in Iowa is that he knows times are tough, but at least kids have health care until they are 26 and the government took over the “terrible” student loan system.

Read MoreExcuse me, may we opt out of Obamacare?

It seems that every day we learn about more and more of Obamacare’s “unintended” consequences brought to light now that, paraphrasing Nancy Pelosi, we have passed the bill and can see what’s in it. This time, the outcry is coming from colleges and universities.

Read MoreYou’re seeing more honors graduates the past few years

I noted this phenomenon in 2002 at the graduation of a family member. There seemed to be a high number of students graduating cum laude, magna cum laude and/or summa cum laude. I certainly did not remember such a high percentage of graduates with honors during my stint (late 1980s) in college. Were students getting…

Read MoreShould Congress get involved with college football?

That’s the question, and your comments are welcome below. My first thought is “no.” But since many schools are government subsidized in some way – including the UCONN Huskies and the Texas A&M Aggies – and media cash involved, the United States Congress is thinking about getting their all knowing legislators involved. Here’s a clip…

Read MoreUp next: student loan forgiveness

Last fall it started. Congressional legislators like Senator Dick Durbin (D-Ill.) proposed – and president-elect Obama supported – “cram down” legislation allowing bankruptcy judges the ability to modify mortgages of primary residences. If lawmakers thought this was a good idea, it was certain that future legislation would allow modification of other loans including automobiles, credit…

Read More