Posts Tagged ‘IRS’

IRS not answering Senate Finance Committee questions

The IRS thinks it’s OK to ask conservative and libertarian groups hundreds of questions, yet they ignore Senate Finance Committee questions posed concerning how the department put into place policies targeting groups including local TEA Party organizations.

Read MoreTax-Exempt Media Matters for America illegally coordinates with Congress (Update)

We’ve known Media Matters for America is hiding behind its tax-exempt, non-partisan 501(c)(3) status, but it’s time the IRS calls them out and pull their tax-exempt approval.

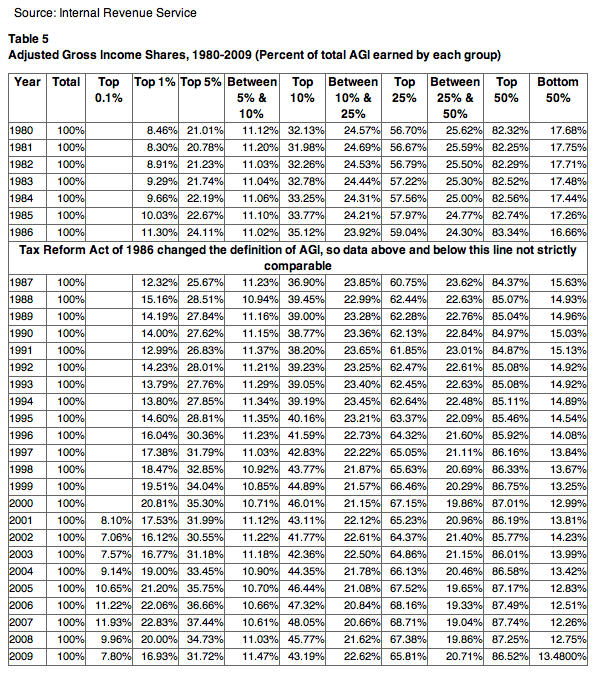

Read MoreDoes it really matter who the Top 1% are and how much they make?

For some, it makes a big difference. I’ve been spitting out tax statistics that people have been shrugging off for years, but I had a revelation earlier today. It does not matter. It’s just another Symptom of the Disease.

Read MoreThe IRS v. charities

This article caught my eye, though I’m still not sure why. It seems troubling on several fronts, so, hopefully you can help me out. Approximately 275,000 nonprofit organizations, lost their nonprofit status with the IRS earlier of this year. To explain, let me begin, as they say, at the beginning.

Read MoreFederal tax figures from 2008 – Limbaugh, WSJ and Powerline

There has been a lot of discussion concerning where the money really is on conservative blogs, the Wall Street Journal and the Rush Limbaugh show. I heard Limbaugh discuss the subject during his first hour yesterday and I thought his presentation was a bit confusing to listeners.

Read MoreO’Reilly vs Congressman Weiner – Who’s on first?

This may be O’Reilly’s most frustrating moment since … ummm … Barney Frank. O’Reilly is tryig to pin down Rep. Anthony Weiner (D-N.Y.) on who will enforce the Health Care penalty for people who choose not to buy insurance and refuse to pay the penalty. A reasonable question … that O’Reilly asks five times. But…

Read MoreObama’s international tax plan – overseas banks balk

A few weeks ago I wanted to put a piece together concerning the implications of targeting domestic corporations who did business overseas. President Obama and his administration have used the attack code-word loophole concerning world-wide corporations who commit the sin of structuring their business to ensure they play the lowest legally allowed amount of taxes…

Read MoreNot Quite Pravda

Imagine a new role for Treasury Secretary and tax cheat Timothy Geithner: editor-in-chief of your local newspaper.

Read MoreYou know that tax break of $7.69? The IRS wants some of it Back

Remember how kind and generous we all thought the young President was being when we got that swell tax cut of $7.69? Yea the one that increased the amount of your weekly paychecks. Well , Huston, we have a problem. The Ap News reporting today that the tax credit was going to provide up to…

Read MoreAudit Congress

Well you knew it had to happen sooner or later. Some of you have already suggested it and I can’t say its a bad idea. Have you paid your taxes lately? If you said “yes” then you are in good company. Millions of Americans not only struggle with the duty of following a convoluted tax code,…

Read More