Posts Tagged ‘irs data’

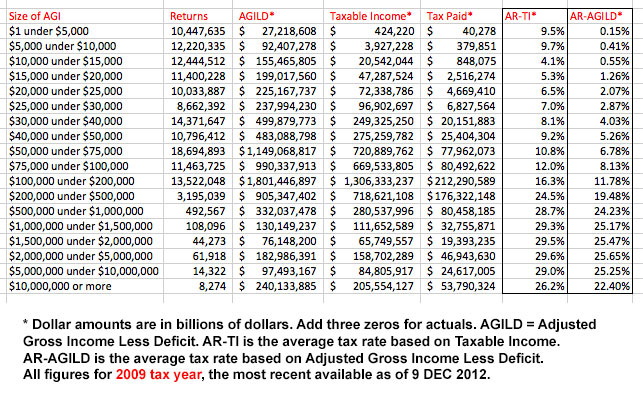

$200k – $500k earners pay double average tax rate compared to $50k – $75k

Deserving of its own post. Here is a table I created from the original. Those earning $200k to $500k – the largest group directly effected by the increased tax rate demanded by Democrats – are paying more than double the rate of the $75k to $100k group!

Read MoreWe’re already spreading the wealth around

Barak Obama had an impromptu conversation with Joe Wurzelbacher, a plumber from Ohio. Wurzelbacher is living the American dream. He’s paying more and more taxes and he’s not happy about it. He asked Obama about his tax plan, “your new tax plan is going to tax me more, isn’t it”? Well of course Obama proclaimed.…

Read MoreAre families and individuals moving into higher income brackets?

In my post from Nov. 1, A close look at the federal tax burden of corporations and individuals, I provide details about the large increase in federal income and corporate tax revenue after the 2001 and 2003 tax cuts. The piece also displays how the federal tax burden moved from corporations, to individuals and back…

Read MoreWe’re already spreading the wealth around

Barak Obama had an impromptu conversation with Joe Wurzelbacher, a plumber from Ohio. Wurzelbacher is living the American dream. He’s paying more and more taxes and he’s not happy about it. He asked Obama about his tax plan, “your new tax plan is going to tax me more, isn’t it”? Well of course Obama proclaimed.…

Read More