State pension funds are ready to implode (Update)

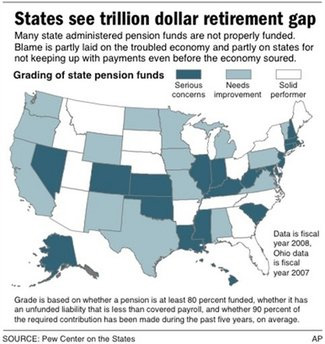

As a follow up to one of Jim’s topics on Thursday’s show, what follows are the grim details. State governments are looking at a $1 trillion shortfall between what they have promised state employees in retirement benefits, and, what the states have set aside to pay for those promised benefits. But, should any more bad news be needed, this figure, from the Pew Center, is based on data as of June 30, 2008.

Since that time, state pension funds have had substantial investment losses, making the Pew figures quite conservative by today’s standards.

The pension problems started well before the recession. Even in good times, states were skipping pension payments, leaving larger holes to fill in future years. State legislatures also increased benefit levels without setting aside extra money to pay for them.

The worst states are Illinois, with only 54% of promised benefits funded, and, Kansas, Oklahoma, Rhode Island, and Connecticut close behind, with only 65% of promised benefits funded. This amounts to a deficit of over $8,000 per American household , and, doesn’t include promised municipal, county or local government benefits that are, no doubt, also underfunded.

Raising taxes to fill pension coffers would be a difficult sell to taxpayers…Public-sector employees in California and other states are facing a growing backlash from residents who are having their own benefits stripped by employers.

Now what? We all know that policemen and firemen perform thankless jobs that most of the rest of us wouldn’t, or couldn’t do. And, that they have been promised benefits by the government, promises that the government should try to keep. But, the private sector has lost millions of jobs in the past 2 years, further eroding the tax base, and taxes collected. So where will this $1 trillion shortfall come from?

UPDATE (Jim): Here are the numbers from Connecticut, per Chris Keating’s article:

Since the state legislature and governors have not set aside enough money through the annual budgeting process, the state’s unfunded pension liability has increased by more than $9 billion since 2000. Connecticut’s pension fund grew by 89 percent between 1999 and 2008, the report says, but the liabilities — the amount the state owes to the pensioners over the long term — grew even faster, essentially doubling.

The nonprofit Pew Center on the States said, “Connecticut’s management of its long-term pension liability is cause for serious concern, and the state needs to improve how it handles the bill coming due for retiree health care and other benefits.”

This, my friends is serious. I can only hope the unions understand just how serious this is.

Update 2 (Steve): Here is the graph from the Associated Press story this morning, pulled from the Pew Center report.

3 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

We can't leave NJ out there alone to turn around the direction of spending. Now is the time for all North East states to do an about face and deal with the crisis of run away public sector employment. If NJ stands alone in doing the right thing, the unions can put the bulls eye on the governor's back and go all in at stopping this essential change dead cold. If more states step up and be a hero to the people for once in my life, then the unions will have too many targets to lawyer up and still manage their election year candidates. Unfortunately Rell has proven a complete coward at cutting payroll . She could not even fire a police dog if her life depended on it.

As wimpy as governor Rell has been, can you imagine what this state's finances will look like if a Dem is elected governor this year???

Jim I agree with you I am a state employee with the dept of corrections but the only difference with hazardous duty staff DOC DEP and State police we pay 15% of our pay toward our pension with that being said 50% of my 3 high yrs is ok because I pay into that, as a tax payer all the other agencies dont pay into it , its a perk. so 50% of there high yrs is unaccepatable it should be of there base pay.

if we changed the contracts so it would reflect a contribution that would deffently save tons of money.

plus I pay for my health ins. after reirement roughly 165 a month yes nice plan but I do pay for it.

also look at uconn professers they retire a 250k job with 125k pension and get hired back at 90day interam contracts 3 semesters at 100k a pop what kind of scam is that.

the problem is upper management starting with the gov. labor made some sacrifices management made none, no positions were elimated no pay raises were cut. by the way our commisioner gets payed as the commisioner but hes not as long as he acts like the commision 2 days aweek aint that some shit