Rental property owners need not apply – Federal energy efficiency tax credits

In central Connecticut there are a lot of two and three family rental properties built in the 1940s through the 1960s. The last few years have been tough for renters paying for natural gas, oil and electricity. Many of those properties could benefit from insulation improvements, yet the federal government says “no way” to landlords looking for an energy rebate to help offset the cost of improvements.

First of all, I’ll argue the energy rebates from the federal government are unconstitutional, artificially increasing the cost of making the improvements. But, if you’re going to offer the rebates, why exclude rental properties? Who suffers the most when the federal government excludes rental properties?

Obviously, normal upkeep and maintenance on rental properties is part of the deal for landlords, but non-emergency expensive improvements will frequently be delayed so funds can be saved up to pay the cost. The current economic situation certainly is not helping.

Obviously, normal upkeep and maintenance on rental properties is part of the deal for landlords, but non-emergency expensive improvements will frequently be delayed so funds can be saved up to pay the cost. The current economic situation certainly is not helping.

Charging higher rents can offset the cost of the improvements. Renters certainly may be willing to pay an extra $25 per month in rent if they could save $50 per month in energy costs, but by denying the $1,500 tax rebate to landlords, there will be a significant number of renters who lose out. That $1,500 might be enough of an incentive to make the improvements this fall, before the rebate program ends.

So, tell me readers … why would the federal government exclude rental properties in the tax credit Energy Star program?

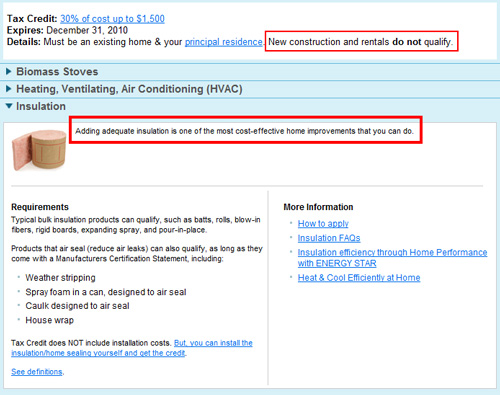

From the FAQ section at the Fed’s Energy Star website.

Q: Can I get the tax credit for a rental property?

A: No, none of the residential tax credits are available to owners of rental properties. They are ONLY available for your “principal residence.”

From the Federal Government’s Energy Star website detailing the available tax credits.

5 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

Maybe they should give extra tax credits to the landlords of those ultra rich liberals in NYC and Cambridge MA (to name a few) that are paying chump change on rent controlled apartments.

I guess with Resko in prison and Jarrett working in the White House, there were no pre-approved slumlords eligible for the credits.

You owe me a keyboard and a cup of cappuccino for that one, Tim! LOL!

How about owner occuoied rental properties?

This federal program was initiated under the guise of "green living", preventing "global warming", stopping "climate change". I guess the millions of multi-family residences (18% of all housing) in the country do not apply and have no affect on the lefties "help the environment" agenda. Contradiction at its best!

From the Energy <a title="Energy Efficiency in Multi-Family Housing: A Profile and Analysis" href="http://www.energyprograms.org/briefs/0706.pdf" rel="nofollow">Programs Consortium:

While the energy efficiency of multi-family housing stock is improving, the rate of improvement could be substantially increased by adopting systematic policies and financing models that use market data and target government policies and programs by housing type, age of housing stock, income and energy use. Increasing energy efficiency in the nation’s multi-family housing will require development and refinement of current policies, incentives and financing structures.

Increasing the energy efficiency of the nation’s low-income multi-family housing will also make it more

affordable. Affordability is especially important since energy prices are rising faster than the overall rate of housing costs in the United States. Between 2003 and 2006, for example, overall housing costs increased by 110 percent, while energy costs increased by 126 percent.