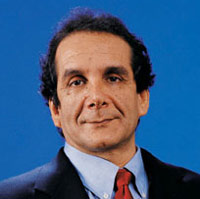

Krauthammer: Obama’s desire for tax rate hikes political – not economic move

On Special Report last night, Charles Krauthammer reminded us the Simpson Bowles Commission identified federal tax loopholes and deductions that totaled more than $1 trillion every year.

Krauthammer stated the debt commission President Obama created…

… identified $1.1 trillion of what is called tax expenditures, meaning loopholes and deductions out there available every year, so over a decade that’s $11 trillion dollars of available revenue without raising rates. So all you need to do is get less than one in 10 of those dollars, one in 10, and you’ve got a trillion dollars in raised revenues without raising rates.

The commission and Krauthammer are totaling up all of the loopholes and deductions available, and in no way is Krauthammer suggesting they all be discontinued. He’s just pointing out we only need to eliminate 10 percent of them to raise the mythical amount the tax rate increase will bring in.

As I have pointed out before, even after I totally stacked the deck in Obama’s favor, the income tax rate hike Obama wants would only generate $40 billion a year … less than $500 billion in a decade.

The IRS does not provide a table broken up by tax brackets, so why don’t we just take a look at the number of returns and taxable income of those who made more than $200,000 in the most recent year we have for data – 2009 (Excel, 59KB). To keep the math simple, we’ll enhance the Obama plan to the point where every single dollar of taxable income over $200,000 is taxed at 39.6 percent instead of the current 33 percent and 35 percent. In other words, I’m totallystacking the deck in Obama’s favor, and ignoring the fact taxable income is less than it was in 2009.

The total taxable income for those making $200k + was $1.626 trillion from a total of 3.913 million returns. Subtract out the first $200k earned (taxed at a lower marginal rate) and you come up with $843.4 billion (1.626 trillion – $782.6 billion) in income that would be taxed at the new, higher rate.

35 percent of $843.4 billion is a revenue stream of $295 billion.

39.6 percent of $843.4 billion is a “new, Obama-approved” revenue stream of $334 billion. That’s a whopping extra $40 billion dollars. The federal government spent $71.5 billon a week in 2010, so the tax increase would cover a few daysof federal spending if all things remained the same, and they would not.

The more common quote mentioned in the media is that Obama’s rates would raise $80 billion a year, but that’s still under $1 trillion over a decade.

So now with this background explained, why is Obama demanding the tax rate increase and ignoring and won’t even consider closing 10 percent of the loopholes and deductions that are available now?

Class warfare works for him and he’s sticking with it. Krauthammer refers to it as pure politics, and nothing to do with economics and he is correct. It’s easier for Obama to push through the tax rate increase on the top 2 percent and claim victory even though many know it won’t do anything to solve any problem.

Click the video to bring you to NRO to watch Krauthammer.

10 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

Don’t you just love the way ?bama and his flying monkeys call the Republican plan “out of balance” and totally ignore it.

?

CK merely states the obvious for the high information voter; information that the low information voter will never even see thanks to a complicit media.

?

The Republicans have to stand tough on cuts, and use facts as you and CK have stated to make their case, and call the preezy’s bluff.

If the Repubs had any testicular fortitude, they would just say that they could not, in good conscience vote for the “Bush tax cuts for the rich” and extend them.? They have to directly state that, as the preezy and the Democrats have repeatedly said (ad nauseum) that these tax cuts “only benefit the rich”.?? Make them eat their words.? Quote the living hell out of them.? The middle class has already been told that these tax cuts don’t help them, and that they hurt the budget, so just keep saying that “we agree with the president”.

If the “Bush tax cuts” expire, the tax rates return to the levels that were found in the Clinton years, right??? The same rates the Dems continually claim were so good for the country.?? So why not let them expire, so we can return to the “glory days” of Bill Clinton??? And quote them heavily on it.

?

How many sides of their mouths do Democrats have, anyway?

I agree,let’s dive off that fiscal cliff.

I don’t know if it’s politics or entertainment. President Obama is pipin’ ” Chicago, Chicago” as we follow him over the cliff.

Oh, no! Deductions can’t be touched! Those thousands of wealthy, and the just plain rich, Democrats would never stand for reducing or eliminating deductions. They would revolt.

?

Example: A mega-rich, influential leftist society matron, editor of a popular women’s magazine, bundles serious cash for the Obama perpetual campaign machine. Everything she does is for the franchise. She is a business unto herself. Deductions are the way to pay less taxes and have more to contribute to the Dem cause. More contributions equals more political capital and more access to the people who matter.

Taken to its logical goal, deductions mean more contributions. More contributions means reelection and a continuation of power. Power can pay off those who contributed to the Cause with plum patronage positions.

Bundle enough for the Regime and you too could be offered an ambassadorship. Say, to England? All those deductions can be parleyed into something more desirable and lucrative . . . than a plain old retail 401k.

Pay to play, all through the power of deductions!

Charles seldom gets anything wrong.

A “Flat Tax” would eliminate every one of them.

In reality it’s likely not at all about addressing anything beyond brainwashing the masses into supporting their own tax increases.? The “super rich” is most likely a straw man that we’re supposed to believe is getting fiscally punished- Treasodent Obama has put much effort into convincing us that the punishment is deserved via demagoguery.? In reality the rich have the means to shift their assets, income, and such out of the tax man’s reach- being super wealthy themselves, our legislators KNOW this.? That leaves the middle class to pay- which was likely intended to begin with

Washinton? Hello,Hello? Is there one Adult in the entire Congress or government or City?