Just in time to buy the banks – Video Added

It looks like the man so smart he couldn’t figure out his taxes will be confirmed as Treasury Secretary. Too bad. Tim Geithner also happens to be one of the “brain trusts” behind the current financial TARP program. You know, the one that’s been trying to bolster bank balance sheets. Soon … he will be asking for more money … and for what?

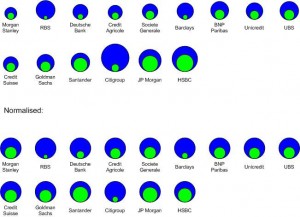

You might find the following chart posted by Cody Willard at Fox Business interesting. It shows what banks were worth in 2007 when they were riding high on the real estate wave and credit swap craze … it also shows what they are worth now. And begs the question … why did they stick with the smoke and mirror balance sheet so long? Why not shed some of those assets when they still had value? Click the graphic to see the full size chart.

You might find the following chart posted by Cody Willard at Fox Business interesting. It shows what banks were worth in 2007 when they were riding high on the real estate wave and credit swap craze … it also shows what they are worth now. And begs the question … why did they stick with the smoke and mirror balance sheet so long? Why not shed some of those assets when they still had value? Click the graphic to see the full size chart.

Update: (Steve) Posted is a new version of the same original chart from the Neil Hume at Financial Times. It still shows bank market capitalization comparison between the second quarter of 2007 and Jan. 20, but this version includes a normalized view, so it is easier for readers to compare relative shrinkage, as Hume calls it. In other words, Citibank = massive hit, JP Morgan = not as bad. /steve

Chat room and Blog contributor Dave suggested it might be time to post that shocking revelation from Fox News … you know … the one that says the Feds have actually pumped more money into the banks (specifically BOA) than its worth.

httpv://www.youtube.com/watch?v=jeJJuMYX5B0

Not sure what the next move is … but my guess is complete government control of America’s capital system. Doomed I tell you. We lose our free market system because of the recklessness of others … and we end up paying for it.

Update: BTW … the podcast with Cody Willard is up on the WTIC site … great interview today.

2 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

if the question is… "why did they stick with the smoke and mirror balance sheet so long?"

They didn't have any choice! They are leverages 40:1 or 50:1 and just a few write downs then easily destroy the bank's ability to lend without becoming more leveraged. So they take the bad stuff and hide it structured investment vehicles (SIV) which are not shown on their balance sheets. Interestingly, when the SIV investments were doing well they would bring some to the balance sheet if they needed a little boost.

So then BOA buys Merrill, but Merril's liabilities are not marked to market (they are not valued at the market price) and it turns out the the government made a deal with BOA that tax payers would reimiburse BOA for the difference between the the "hypothetical value" of the Merrill trash and the real value (marked to market) value. I bet your are thinking that this comes out of TARP. Well this is not really all that clear, and my guess is that TARP money PLUS money created out of thin air by the Federal Reserve has gone to pay BOA, my guess is that this figure is astonishing. Like maybe $2 trillion when it is all said and done. But that amount IS ONLY for the Merrill transaction. Multiply this by all of these bad banks like Citi. Wait till that deal is done!! So what are we looking at $10 Trillion in bail out, JUST FOR BANKS. I am not a doomsdayer I am realist.

-Erik

Was there a choice? I am not sure that anyone knows with any certainty.

I would like to offer my perspective, as a CPA who has worked for two major accounting firms on financial institutions. This just isn't my view, but I will add support from others such as this article from John Berleau in the September 20, 2008 Wall Street Journal entitled "Maybe the Banks Are Just Counting Wrong" ( http://online.wsj.com/article/SB12218651556215867….

To make a long technical discussion short, it wasn't until just very recently that banks and other financial institutions were required to revalue large amounts of the assets on their books (loans, securities, etc.) to their market value – on a continual basis. The latest pronouncements were implemented by regulators in November 2007 – and this required mark to market accounting even for assets for which there was no ready market. Banks are then required to look to "comparable" sales – which could be fire sales by competitors.

As stated by Mr. Berleau in the article, this can set off horrific consequences (my term, not his). Even if the impairment in value is temporary (due to market conditions or sales by others), banks have to write their assets down. As one bank collapses, their sales flood the market – which leads market values to plunge further. As a bank's capital is eroded by write-downs, their response is to shrink in size – to maintain required capital adequacy ratios. So, the rate of sales – and market (or pseudo-market) prices plunge further. It creates what we saw – a house of cards – collapsing very, very quickly.

Once the tumbling slows and then stops, the value of these assets in the markets stabilize and eventually increase – allowing the write-downs to be reversed and the values increased. This could happen pretty much anytime, perhaps as of today – when President Obama takes office.

Treasury Secretary Paulsen and the Regulators could have suspended the mark to market rules. They chose not to. Why not? Why did they choose to implement the mark to market changes in the first place?

The rate of delinquency on mortgages is high, but not off the charts. We have seen far worse before without consequences such as we are seeing now. Sure, there are some complications – like the credit default swaps – which mess up the works. But, the heart of the problem began with the residential mortgage loans.

So, what is the real value of these banks today?