IRS sends $46 million in refunds to 24,000 at one address

And this is the organization that will be in charge of the Obamacare mandates. Remember the Inspector General audit pointing out the targeting of TEA Party groups when it came to IRS tax-exempt approvals? We also have another audit – again published last summer and not released to the media prior to the election – pointing out a huge problem with the distribution of IRS refund checks.

Here is a direct link to the report [PDF] posted on the government’s Treasury website. Here is a broad view of the results.

- Management Has Created an Environment Which Discourages Employees From Detecting Fraudulent Applications

- Management Has Eliminated Processes Used to Identify Questionable Individual Taxpayer Identification Number Application Patterns and Schemes

- Processes Are Not Adequate to Verify Each Applicant’s Identity and Foreign Status

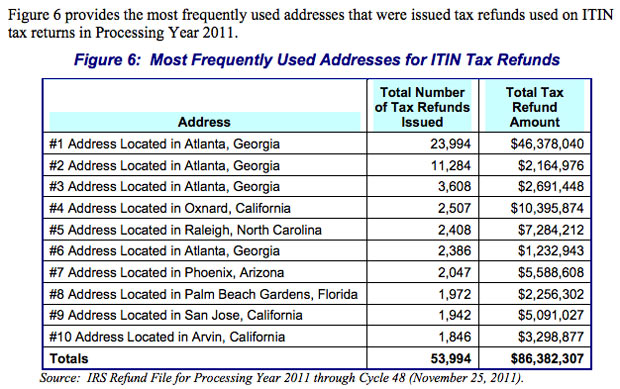

Makes you feel all warm-and-fuzzy about health care and the federal government right? From Page 18 of the audit, we find the following table, noting that one address – on one year (2011) – received $46 million in tax refunds sent to 23,994 different people represented by ITIN numbers.

Nah, this isn’t really a problem is it?

To some how summarize this mess, it’s very easy to get an ITIN, which is a number assigned only to resident, legal aliens who are working in the United States and are not able to have a Social Security number. Once one has an ITIN, it is much easier to collect benefits and commit tax fraud. This tax fraud can be done on a small scale or – as we can plainly see from the top 10 most frequently used ITIN addresses – in a very large scale. From Page 6 of the report.

Some of the deficiencies we raise in our report have been brought to management’s attention long ago. Some were raised in a September 2002 report issued by an IRS-initiated Task Force. However, management has failed to take sufficient action to address those deficiencies. As we have also previously reported, the amount of Federal funds individuals have access to once they have an ITIN assigned is substantial. For example, in Processing Year 2011, claims by ITIN filers for the refundable credit known as the Additional Child Tax Credit totaled $4.2 billion. For the ITINs assigned in Processing Year 2011, we identified more than 481,500 (71 percent) of the tax returns associated with the ITIN application had claims for the Additional Child Tax Credit totaling more than $916 million. For Tax Year 2010, the Child Tax Credit could reduce an individual’s taxes owed by as much as $1,000 for each qualifying child. The Additional Child Tax Credit is given, in addition to the Child Tax Credit, to individuals who receive less than the full amount of the Child Tax Credit. The Additional Child Tax Credit is a refundable credit that can result in a Federal tax refund that is larger than the amount of a person’s Federal income tax withholding for that year. Individuals can receive a refund even if no income tax was withheld or paid.

Therefore, it is essential that the IRS have adequate processes and procedures that ensure only qualified and eligible individuals are assigned an ITIN.

This report will be ignored by the main stream media as usual. I first read about this over at Michelle Malkin’s blog five days ago and I was wondering if anyone picked it up. Quite a few blogs have it and even two local network affiliates in Atlanta are covering it, but Fox News? CNN? ABC News? CBS News? Crickets…

If you ask the IRS, they will say this was a problem before, but new processes have been put in place so we don’t have to worry about it anymore.

6 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

This is no accident. This is a reparation program – clear and simple. Obama believes the United States is an unjust country and it’s time for payback.

This is a?systemic problem with the federal government and has been for decades. It has little to nothing to do with Obama or reparations. Please embrace that, and understand the solution to this symptom of the disease is a much smaller federal government.?

$86 Million- Obama’s blowing $100 Mils with a week in Africa! ?And he dares ask whether you’ve paid your fair share! ?That man needs a check-up from the neck up! ?Oh, and have you seen the new NPR headquarters!? ?No wonder they think the economy is fine!

Once word gets out that the system or a program can be gamed – sometimes with the help of government employees – it’s a made scramble for cash until somebody squeals, and the hole is patched. Then another leak springs and so on and so forth.

I would be curious how many of the 47% were involved in this waste of our money? Secondly, what is being done to recover these funds? (stupid question,right?)

It has become an entitlement…