India buys a lot of gold

I’m not a financial expert, but this can not be good at all. India has purchased $6.7 billion in gold, swapping out U.S. dollars for the precious metal. Hopefully those in the know will try to figure out why. (Hint: Check out the chart below the fold.)

In the grand scheme of things, $6.7 billion is not a huge amount of money, but I think it sends a clear signal to the United States and Europe they need to get their financial house in order.

Hat tip to Gateway Pundit, with a link to the Financial Times.

Pranab Mukherjee, India’s finance minister, said the acquisition reflected the power of an economy that laid claim to the fifth-largest global foreign reserves: “We have money to buy gold. We have enough foreign exchange reserves.”

He contrasted India’s strength with weakness elsewhere: “Europe collapsed and North America collapsed.”

“This is a landmark trade,” said Jonathan Spall a director at Barclays Capital and a gold specialist. “Central banks are conservative institutions and India’s move is a sign for other central banks and sovereign wealth funds that were contemplating buying gold.”

New Delhi’s acquisition came months after China revealed it had almost doubled its gold reserves in the past six years.

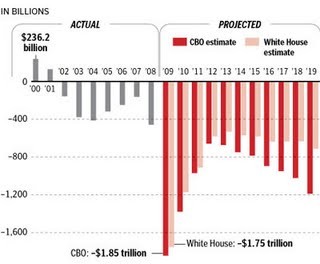

What do you expect, when the United States government publishes deficit projections like this?

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.