Connecticut Budget: Malloy starts with tax increases, where are the cuts?

I’m serious. I’m waiting to hear about these supposed $2 billion in cuts. Total spending by the state of Connecticut has increased from $13.4 billion in 2001 to an estimated $26.1 billion dollars in 2011. That’s almost doubling the state budget in 10 years. Connecticut did not ride the TEA Party conservative wave, and we may just pay for it big-time.

Today, news broke from the capital that “there will be pain” with talks of an increase in the income tax for those earning more than $50,000 and couples earning $100,000. That’s a tax increase on the middle class and retroactive to Jan. 1. The tax increases do not end there. We’re talking HUGE across the board increases in taxes. The middle class and everyone else will also have to fork out additional tax dollars for cigarettes, gasoline, alcohol and almost everything you buy since Gov. Dannel Malloy’s (D) plan will include on a hike to the sales tax.

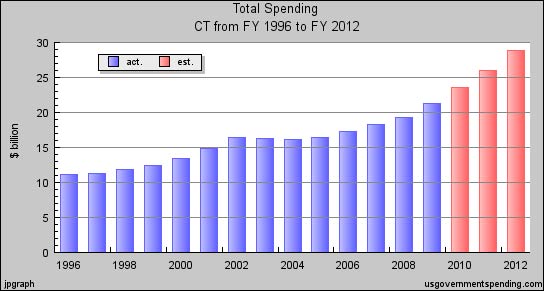

The governor and state legislature are going to have a damn tough time explaining this graph. The actual spending in 2009 was $21.33 billion, and it is estimated we spent $23.6 billion in 2010. The damn state – even in a period of recession – increased their spending by more than 10.6 percent in one year. (Chart from USGovernmentSpending.com) My pay increase the past three years has totaled less than 1.1 percent. How did you do?

Even if Malloy does somehow cut $2 billion, that would only return state spending to 2009 levels. Heck, we’d still be spending more than we spent in 2009!

The Hartford Courant has more.

In one of the largest tax increases in Connecticut history, taxes on income, cigarettes, alcohol, gasoline, and estates would all increase under Gov. Dannel P. Malloy’s budget proposal to be unveiled Wednesday.

Great way to start. Maybe Gov. John Rowland was right today when he said this budget is dead on arrival, but with a Democrat legislature and a Democrat executive, I’m willing to bet they will try.

For middle-class homeowners, one of the biggest changes would be the elimination of the $500 property tax credit that Democratic legislators have supported through the years. In addition, the sales tax exemption for clothing and shoes under $50 would be repealed – meaning those items would now be taxable for the first time in many years. The property tax credit and the loss of the clothing exemption amount to a combined tax increase of $500 million per year.

Thousands and thousands of families who buy reasonably priced clothing for their family will get screwed. I can’t remember paying sales tax on any clothes I’ve ever purchased. If you have a couple of kids who grow like weeds and you shop at Target for clothes, you’re toast.

Taxes will increase on virtually all taxable items. The gasoline tax would rise by 3 cents per gallon, while the cigarette tax would increase by 40 cents per pack to $3.40. All alcohol taxes would increase, which Malloy says would amount to pennies on a six-pack of beer.

Overall, Malloy is proposing more than 50 different tax changes in a package that would increase taxes by $1.5 billion in the first year and $1.34 billion in the second year.

Various sales tax exemptions would also be repealed – meaning that the state’s sales tax would now be charged on haircuts, manicures, pedicures, yoga, car washes, yacht repairs, limousine rides, airport valet parking services, cosmetic surgery, pet grooming services and non-prescription drugs. All of those items had avoided the sales tax through lobbying efforts and inaction by the state legislature.

The sales tax would rise statewide to 6.25 percent, up from the current 6 percent, on all taxable items. In addition, cities and towns would be eligible to receive an estimated total of $24 million statewide from an additional .10 percent – meaning that the sales tax on some items in retail stores could be 6.35 percent.

Read the full Courant article for even more hits including eliminating the property tax credit. Don’t worry though, he’s proposing taking money from the middle and upper classes and handing earned income tax credits to the poor.

Fantastic. So, the governor’s budget is supposed to come to life on Wednesday. We’ll see if he actually cuts anything. Remember the total spending in past years… How much of the spending increases were “required” by employee and union contracts? That stuff is never negotiable.

In January, Malloy supposedly told lawmakers he was going to rely primarily on budget cuts to make up the budget gap, and he’s refused to borrow from the bond market to pay day-to-day expenses and salaries for state employees.

If you’re wondering what it would look like with a Democrat in the Governor’s Mansion and Democrats running the state legislature, I think we’re about to find out in the coming weeks.

Where are the cuts?

12 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

And all this time I thought the Democrats were for us working people (yeah, right)……

Seriously? Voters actually expected Malloy to make CUTS? I heard this yesterday and nearly drove off the road…I have never been so ready to leave this God forsaken state as I am now. The democrats are going to take what's left of this state, dig a hole 6' deep and proceed to bury it. So many of us predicted that this was going to happen with a unitarian state government…so many wouldn't listen. How about those "cuts" Malloy made by "streamlining" state agencies? What was that…Like $10 million in savings? This guy will, with the help of the dem legislature, be the death of this state. I'll be doing my shopping in MA & NH from now on.

Lets See there going to increase taxes.. really why does this surprise you get ready

Increase tax on gasoline

increase tax on cigarettes

increase sales tax

do away with tax free shopping week

clothes not normally taxed will now be taxed

hair cuts taxed

dog grooming services taxed

Increase personal income tax on on individuals and married couples

Car washes

hair cuts

yoga

road and towing services

a new luxury surcharge of 3 percent

hotel tax increase from 12 to 14%

Registration fees and drivers licenses cost increases

Oh even better

a proposed 2/10ths of a cost in crease per kilowatt hour of electrical generation

Wow….I really do not know what to say I am not surprised but really???

I suppose December 2012 really couldn't come fast enough for me.

It's the Will of the people, our last will and testament!

Democrats raise TAXES. History doesn't lie. When will the light go on?

I love Connecticut, but frankly, I can't afford to live here any longer. I work for municipal employees — you know. the ones who work 183 days per year while most people work 233 (assuming 3 wks vacation and 6 holidays — much more time off than I EVER got when working in the advertising industry)? They do not provide me with health insurance and give me only 5 paid vacation days and 5 sick days. Now that I've finally decided to bite the bullet and purchase health insurance because I'm getting older and may need it — and NO, you're not paying for me because I don't go to a doctor unless I'm so sick I can't work, and then I pay for it myself — I find that between the cheapest health insurance available, the increase in State taxes, and the increase in Federal taxes, I simply will not have enough of an income to live here. Governor Malloy was bought and paid for and supported by municipal and State unions — as usual, their wishes will come before ours; they will continue to retire after 20 years while everyone else works until 70. As soon as I can put my condo on the market without paying back the first-time homebuyer's credit — a purchase I was only able to afford after working for 36 years! — I will HAVE to do so and move to either Texas or Florida. It's not even a choice any more … it's a necessity. Thanks, Governor Malloy — you can figure out how to pay back all those union members without any of MY money and without any new businesses coming into this state. I hope the power you've gained is worth knowing how many lives you will have destroyed.

I KNEW WE WERE IN TROUBLE WHEN WE COULDN'T CALL HIM DAN ANYMORE

KEVIN SULLIVAN JUST GOT A JOB WITH MALLOY AT A SALARY OF $170,000.00 PER YEAR

DAN HIRED A GROUP WHICH WAS NOTED IN THE WATERBURY PAPER. NONE WILL BE MAKING LESS THAN $130,000.00 PER YEAR

WE ALL MUST FEEL THE PAIN

NH looks better each and every day. The day my wife retires we're outa here. You can talk and argue all you want within this state. You can run any person in the country in this state as a conservative. They have no chance. Why? The state is Connecticut blue and will never change. The only people that get elected that are not Democrats are RINOS.

It is time to PUBLICLY EXPOSE all the waste in terms of state spending and state employee abuse.

I will start. I know of MANY, MANY people at Manchester Community College who work 17 hours, get paid for 25, and get FULL, VIRTUALLY FREE health insurance…..for their entire families.

Maybe with the help of Jim, we can create a very public website or blog, where we can ALL REPORT such abuse, and start a grass routes campaign to save our state. I really do believe that finally, people are starting to say ENOUGH IS ENOUGH. I am even ready to name names, and report people I know, because this all has to stop.

I hope you all read this, and maybe we can start something moving in a positive direction. We really do have power, so please, never assume you don't

These antidotes can be considered nice "red meat" for fiscal conservatives, the problem is it's all hearsay. The information should be public, so why not go to the school and get the information about the salaries, benefit plans and pensions for these employees. "I know many people who…" does not cut it in my book. Freedom of information requests can provide quite a bit of information. Working for 17 and paid for 25 with "free" health care? You'll need to specifically prove that case with documentation. I'm not saying you need to "name names" but you can say employee number "3345" has this. Come to think of it, naming names would simply be counter-productive, just a unique identifier would be fine.

One other thing. I'd be happy to write stories right here at RVO about such "abuses" if I'm provided with documentation. Heck, I'll even create a form where you can call out specific deals with unions or state/local employees and upload the documentation.

The Governor?should be honest with CT taxpayers and call his plan “Continual Sacrifice”?? Since he is freezing state spending at the high rate that created the deficit we have rather than actually reducing the overall size of the budget, these new taxes can never go away.