Borrowing more than you can pay back – not a good idea

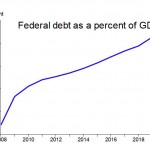

Looking for a loan? Mortgage lenders take a look at your debt to income ratio. In general, the more you earn the more you can borrow. How does the debt to income ratio look for the United States?

Not so good it turns out. Although federal government tax revenue could be considered income, economists use gross domestic product (GDP) rather than expected tax receipts. If you were uncomfortable with the debt to GDP ratio or yearly deficits during the last 30 years, you should be freaking out. As Michelle Malkin frequently reminded us during the porkulus fight in the spring – it really is generational theft.

The federal government borrowing cash – to a certain point – is not a bad thing since they do have income coming in and products being produced. I guess in a simplistic way, it’s like buying a house or a car. You may not be able to pay cash, but if your credit and income is good, the bank is willing to take a risk and lend to you, with the intent to make a profit (interest).

Here are some charts John B. Taylor, professor of economics at Stanford University and senior fellow at the Hoover Institution uses in economics lectures currently. He’s got a brief post about the subject on his blog.

Click on an image to enlarge and scroll through. Sorry the thumbnails are kind of mashed together.

If you were a loan officer – you know where the United States goes to borrow money don’t you? – would you feel comfortable loaning trillions – yes trillions – to our country?

2 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

Maybe China has a "stimulus package" in mind for us.

Love projections 60 years forward (would not put too much trust in them). Wonder how things looked going forward in 2007.