Are families and individuals moving into higher income brackets?

In my post from Nov. 1, A close look at the federal tax burden of corporations and individuals, I provide details about the large increase in federal income and corporate tax revenue after the 2001 and 2003 tax cuts. The piece also displays how the federal tax burden moved from corporations, to individuals and back to corporations between 1995, 2001 and 2007 respectively.

One of my readers mentioned the population increase between 1995 and 2007. An increase in population alone could result in these changes. More people working and companies doing better – both very good things – could explain the increase. We could be pessimistic and say the rich got way richer and the poor and middle class were left behind.

After a review of additional IRS tax data, it’s clear there was a shift. Most everyone improved their status.

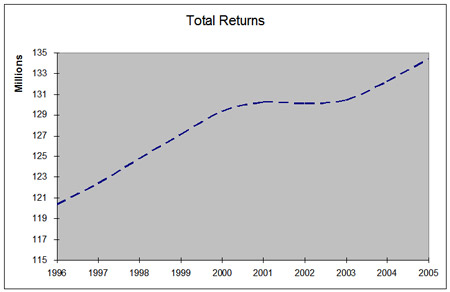

First, let’s take a look at the total number of individual and family returns submitted between 1996 and 2005. The decade shows more than a 10 percent increase, from 120 million to 134 million returns.

So what happened to the lower class who made between $15,000 and $30,000 per year? The chart below shows three groups. Although these charts are not indexed to inflation, the percentage of returns received in each group went down.

As an example, 11 percent of returns submitted in 1996 were from individuals and families with an adjusted gross income between $15,000 and $20,000. Ten years later, 8.6 percent – 2.4 percent less – were in that category. This spreadsheet shows that many filers in these groups moved out of their previous class and into higher income brackets.

Next, let’s take a look at the upper class. Those making more than $75,000 – as a percentage – also grew over time. There was a significant increase in the number of individuals and families who made between $75,000 and $200,000. Those in the $100,000 to $200,000 categories doubled, and those in the $75,000 to $100,000 category increased by almost 62 percent.

The percentage of families in higher income categories – not shown in the charts but available in the spreadsheet – also more than doubled during the 10 year period.

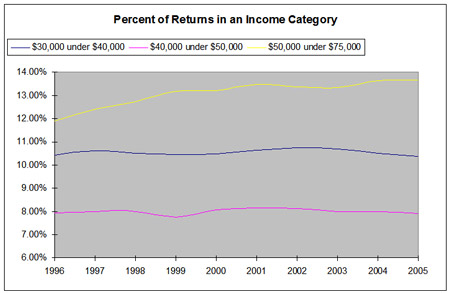

So how about the middle class? In this chart, we’re looking at three groups representing individuals and families that made between $30,000 and $75,000 again between 1996 and 2005. The percentage of returns that fall into the upper category – $50,000 to $75,000 – showed an increase of more than 13 percent, while the percentage of filers with an adjusted gross income between $30,000 and $50,000 remained flat.

Before you ask, yes, the percentage of returns in the $30,000 to $50,000 brackets have remained flat, but remember that those making between $15,000 and and $30,000 moved into these brackets, while others moved out of them and up into the $50,000+ brackets, thus they generally remain flat.

These results shows families and individuals are moving into higher income brackets; lower into middle or upper and middle into the upper classes. A rising tide does seem to float all boats.

Data for this post came directly from the individual statistical tables by size of adjusted gross income for the years 1996-2005. I went to the Individual Income Tax Returns Filed and Sources of Income section and looked at individual returns classified by adjusted gross income. The table that I provide is a cleaned up version of the individual Excel spreadsheets found on the IRS Web site.

How about taking a few moments to forward this post via e-mail to your friends and family?

1 Comment

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

Classic Laffer Curve effect. Obama refuses to believe in it, even though both Reagan and Clinton proved it to be true. Have to be "fair" you know.

It just demonstrates his ignorance of things economic. At least McCain could admit his faults.