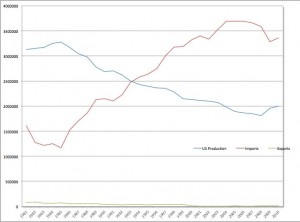

US production of crude oil, imports and exports – Actual Data

I’ve been meaning to reformat this data and post here for some time. It includes data from the U.S. Energy Information Administration (EIA), a government entity which collects data and produces nothing more than Excel spreadsheets (most likely). Lots of oil production data…

I’ve often heard about the United States exporting a bunch of the oil that we drill out of the ground. I’ve also heard that our production is way up, and the greedy oil companies are simply exporting that production. I’ve heard the oil that would come from Canada via the proposed Keystone pipeline would be simply refined and shipped out.

Well, the federal government’s own statistics do not prove that to be the case. As it turns out, US oil production since 1985 has been on the decline. As a matter of fact, we are drilling – here in the United States – about 37 percent less crude oil than in 1985. In fairness, production actually did hit a 30 year low in 2008 where field production was about 1.81 billion barrels and it’s climbed to just under 2 billion barrels in 2010. 2010 is the last full year available at the EIA website for that statistic.

Well, the federal government’s own statistics do not prove that to be the case. As it turns out, US oil production since 1985 has been on the decline. As a matter of fact, we are drilling – here in the United States – about 37 percent less crude oil than in 1985. In fairness, production actually did hit a 30 year low in 2008 where field production was about 1.81 billion barrels and it’s climbed to just under 2 billion barrels in 2010. 2010 is the last full year available at the EIA website for that statistic.

How about exports? US crude oil exports were at their lowest in 2002 (3.3 million) but have climbed up to about 15 million barrels in 2010. I’m talking millions here, not billions. Simple math tells us we are exporting 2.8 percent of our total oil (imports plus US production). Not much … compared to 1985.

In 1985 when field production in the United States was 3.27 billion barrels and we imported 1.17 billion barrels, we exported more than 16 percent of the total oil we had. As a percentage of what we have, we exported a lot less oil than we did 25 years prior.

How about Refineries?

We’ve heard comments that we need new refineries, but what is actually happening with them? EIA data shows we had 254 operating refineries in 1982, and we’re down to 137 in 2011. During the past 30 years or so, about 7 percent to 15 percent of the refineries were off line. 6 percent to 7 percent have been off line for the past three years. This is normal, since you can’t expect 100 percent of a manufacturing operation like that to be up 100 percent of the time.

So yes, we’re not just not building refineries, they are also being consolidated and/or shut down. I say consolidated because even though we have fewer refineries, crude oil distillation capacity has remained flat for almost 30 years. That’s right … our ability to distill the crude oil into a usable product has basically remained flat.

What say you concerning these numbers from EIA?

6 Comments

The website's content and articles were migrated to a new framework in October 2023. You may see [shortcodes in brackets] that do not make any sense. Please ignore that stuff. We may fix it at some point, but we do not have the time now.

You'll also note comments migrated over may have misplaced question marks and missing spaces. All comments were migrated, but trackbacks may not show.

The site is not broken.

Doubtless, the latest production bump coincides with the doubling of the price of oil since ?bama took the helm.? I just had an opportunity to glance at an old WSJ from Nov. 2008 lamenting the decline in the barrel price to below $50.

?

We need domestic resources developed for one of the very reasons the price is spiking now: threats by Iran to close the Straits of Hormuz in response to an attack on their uranium enrichment program.? We can’t protect the Straits, but we can protect a Keystone pipeline.

I distrust all government figures. But then I distrust all big business figures too. The old adage applies; Figures don’t lie but liars figure.

As I understand it, the large amount of export is not crude oil, but rather the products of the refineries, i.e., gasoline, fuel oil (especially), diesel fuel, etc.?

There are no easy answers. Especially when it comes to oil and this Regime.?

Increase domestic production and import less foreign oil. We only import foreign oil to cover the shortfall of domestic production.

There are many ways to increase domestic production: increase drilling permits, lease more land for exploration, streamline approval for newly identified oil fields, build more refineries now, repair and restart idle refineries and increase transmission, pipeline capacity.

And, increase the interest rate. Not popular, but without it, money will stay in speculation, oil commodities, and away from infrastructure investment.

We need a new president!

you all are forgetting that they are counting natural gas in the production and export numbers. i believe it is what is the big factor left out of the export numbers.

That is not the case with the numbers used in my post above. I pulled data specifically to “U.S. Field Production of Crude Oil and Petroleum Products.” There is a second line item and spreadsheet data set for “U.S. Gas Plant Production of Natural Gas Liquids and Liquid Refinery Gases.”